Content

Negligence doesn’t favor any investor, regardless of where they come from. Business finances, however, can be a difficult aspect of the investing world that not many are familiar with. Between terminology and the complex nature of numbers, accounting can get pushed to the side. Proper real estate bookkeeping is one of the most, if not the most, important factors of your business. If you want your company to grow and run smoothly, you need to stay on top of finances – business and personal.

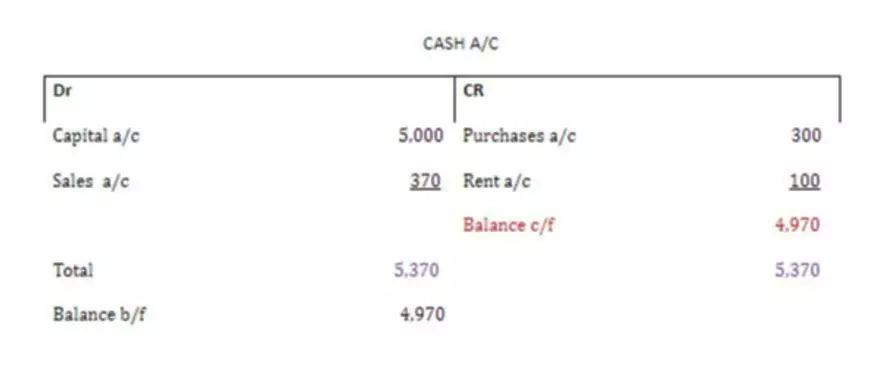

Peace of mind comes standard when your real estate accounting is complete, accurate, and your books are pristine. Peace of mind comes standard knowing your real estate accounting is complete, accurate, and your books are pristine. You can learn more about our services by reading this site, plus check out our introduction to real estate bookkeeping webinar. Each income and expense transaction recorded on the chart of accounts should have a backup or supporting document. Accounts are created within each category for different transactions. For example, in the revenue category, a landlord may have individual accounts for rental income, late fees, and other rent .

Itemize income and expenses

By providing your tax professional with tax-ready financial statements, you’ll make their job much easier and reduce the number of billable hours they charge to you. A yearly visit, or preferably, visits at least twice a year, are highly recommended.

- Having support with bookkeeping software is essential to protecting your business.

- Investigate in a good tenant screening service to avoid renting to a bad tenant and have the prospective tenant pay the application fee.

- You can ask us at ShoreAgents for help with your real estate bookkeeping work.

- No matter your size, volume, or business model, our experienced real estate accountants and bookkeepers will streamline your investing business, putting time and money back in your hands.

This sample real estate agent chart of accounts is meant only as a guide; you should customize the accounts to meet your individual needs. Ben Sutton is the founder of Mazuma USA, an accounting firm providing tax, bookkeeping and payroll services to small businesses. Since founding Mazuma, Ben has established himself as an expert in the small business world. Ben is a Certified Public Accountant, and a member of the American Institute of Certified Public Accountants. But Ben considers his greatest achievement and credential to be his happy wife and four children.

A Clean Start: Bookkeeping for Real Estate

For real estate investors to be successful, they must never overlook the importance of keeping an accurate record of their daily financial transactions. To ensure the numbers are correct, enlisting the help of a trustworthy and reliable public accounting firm to handle their real estate business’s bookkeeping real estate bookkeepering needs is vital. If you have fallen behind on your books, then Bench offers retro bookkeeping services to help you get caught up. Realtyzam lacks some accounting features, like invoicing, online payments, inventory, and time tracking, but we believe it’s not a major concern for real estate agents.

Accurately categorized transactions and reconciled bank accounts along with a financial package delivered every single month. When you first start, the most important habit is to track and categorize everything, even if it’s through a simple spreadsheet. This builds a firm foundation to expand upon when you choose to get more advanced. These two systems are two sides of https://www.bookstime.com/ the same coin, working in tandem. Books without the paperwork mean an IRS auditor may never believe your claimed expenses. But if you have paperwork and no records, you’ll never have a clear, easy-to-understand summary of the financial happenings of your business. Before diving into the five steps to successful real estate accounting, let’s cover the basic terminology.

Why Do you Need Accounting for Your Real estate Business?

The money you bring in to your real estate business can be extensive.You’ve got money coming from buyers or renters and investors. But you also have money going to vendors, people you acquire properties from, and various governments. A great time to separate these accounts is when you officially file for an LLC, S Corp, or other business entity. By doing so, you will be required to file your business taxes separately from your personal ones. It may seem like a hassle or extra step when you are first starting your business, but this process can provide an invaluable layer of legal protections down the line. Open a business bank account to keep personal and business income and expenses separate.

In providing this information, Roofstock does not recommend or endorse any third-party provider nor guarantee their services. Roofstock may receive compensation or other financial benefits from service providers that market on this site, as authorized by law. A chart of accounts for a rental property usually contains categories for assets, liabilities, equity, revenue, and expenses. Business and personal income and expenses should not be commingled with one another. That’s why most real estate investors open a business checking account for deposits and expenses, along with a debit card or card. Contact Us to outsource your requirements for efficient real estate bookkeeping services. Our experts will follow-up with a customized quote within 24 hours.

Additionally, these month and year-end checklists allow business owners the ability to make solid financial decisions on a consistent basis. Send us an email below, and a real estate bookkeeping specialist will be in touch. Net cash flow reports the cash moving in and out of your account over a given period of time. Bookkeeping and accounting in real estate describe two different things.

Asheville Airbnb business owner’s bond revoked; violations: hired prostitute, wire fraud – Citizen Times

Asheville Airbnb business owner’s bond revoked; violations: hired prostitute, wire fraud.

Posted: Tue, 29 Nov 2022 10:23:01 GMT [source]

We work with all tax and budget rules based on your country, so you can ask us for assistance whether you’re in the United States, the United Kingdom, Australia, Canada, or New Zealand. You need to note how your credit score is working when you manage your business. You will have a better chance preserving your credit score if you can manage your payments and handle your finances. Having a quality credit score is essential for qualifying for loans and for getting more favorable terms on any financial services you might wish to request. You can use your bookkeeping records to see how well your business is running.

Agents

We can provide one-time accounting services or help you out on an ongoing basis. We can even help you prepare for an audit, if the need ever arises. As a real estate investor himself, he understands the process and the language of the industry. He enjoys working with other investors and passing on his wealth of bookkeeping knowledge. Capitalized means the expense of the purchase will be recorded over the life of the asset instead of right away when the purchase was made. For example, that new roof might have a lifespan of up to 25 years. The IRS and general accounting principles require the cost of the new roof to be spread out over that time.

What are the benefits of an efficient real estate bookkeeping system?

By keeping track of all the transactions that flow in and out of the business, a bookkeeping system improves the flow of cash. By tracking all income and expenses, bookkeeping provides insight on how to maximize revenue and minimize expenses. Bookkeeping also creates documentation and a paper trail in case the company is ever audited.